Reverse Document- FB08 (FB08)

Purpose

Use this transaction to reverse a document.

When To Do This

Perform this procedure when you want to reverse a

document.

Prerequisites

·

A document can only be reversed if:

·

it contains no cleared items

·

it contains only customer, vendor, and G/L account items

·

it was posted with Financial Accounting

·

the entered values (such as business area, cost center, and tax

code) are still valid

·

the user has authorization to do so.

Menu Path

Use the following menu path(s) to begin this transaction:

·

Select Accounting Financial

Accounting General Ledger Document Reverse Individual Reversal to go

to the reverse document screen.

Transaction Code

Helpful Hints

·

If a line item from a source document has been cleared, a reversal

can only be carried out after the clearing has been reset using transaction

code FBRA.

Procedure

1. Start

the transaction using the menu path or transaction code.

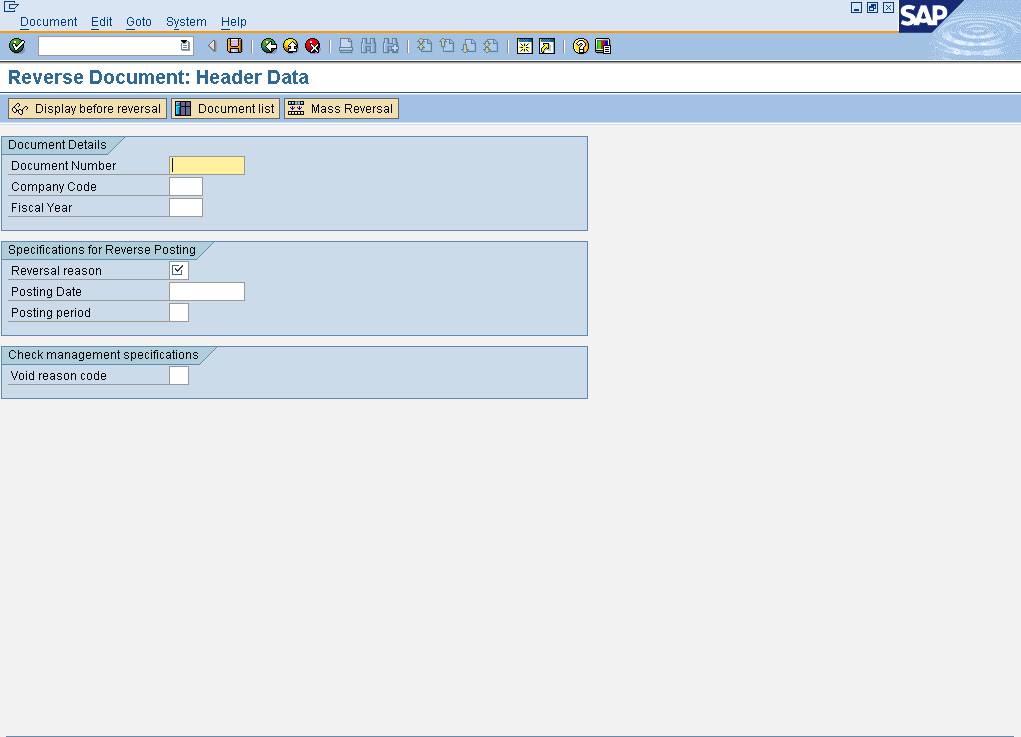

Reverse Document: Header Data

2. As required, complete/review the following fields:

|

Field Name

|

R/O/C

|

Description

|

|

Document Number

|

R

|

The unique

identification value assigned to a business event as it is processed in SAP;

the system automatically creates and assigns document numbers as each

document is posted--manual assigning of document numbers is not possible.

Example: 200000000

|

|

Company Code

|

R

|

Independent accounting

unit; in most cases is a legal entity. You can prepare a balance sheet and

income statement for each company code. Several company codes can be set up

to manage the accounts of independent companies simultaneously.

Example: 1051

|

|

Fiscal Year

|

R

|

The fiscal year for

which this transaction is relevant. In most cases, the fiscal year

corresponds to the calendar year.

Example: 2005

|

|

Reversal reason

|

R

|

The reason that an entry

is reversed.

Example: 01

- Reversal in current period

|

|

Posting Date

|

R

|

The date on which a

transaction in SAP will be posted to the appropriate accounts. SAP will

default this field to be the current date, but changes are allowed. For

items to be posted in a future or past period, you must enter the posting

date.

Example: 11/23/2005

|

3. Click  to view the document.

to view the document.

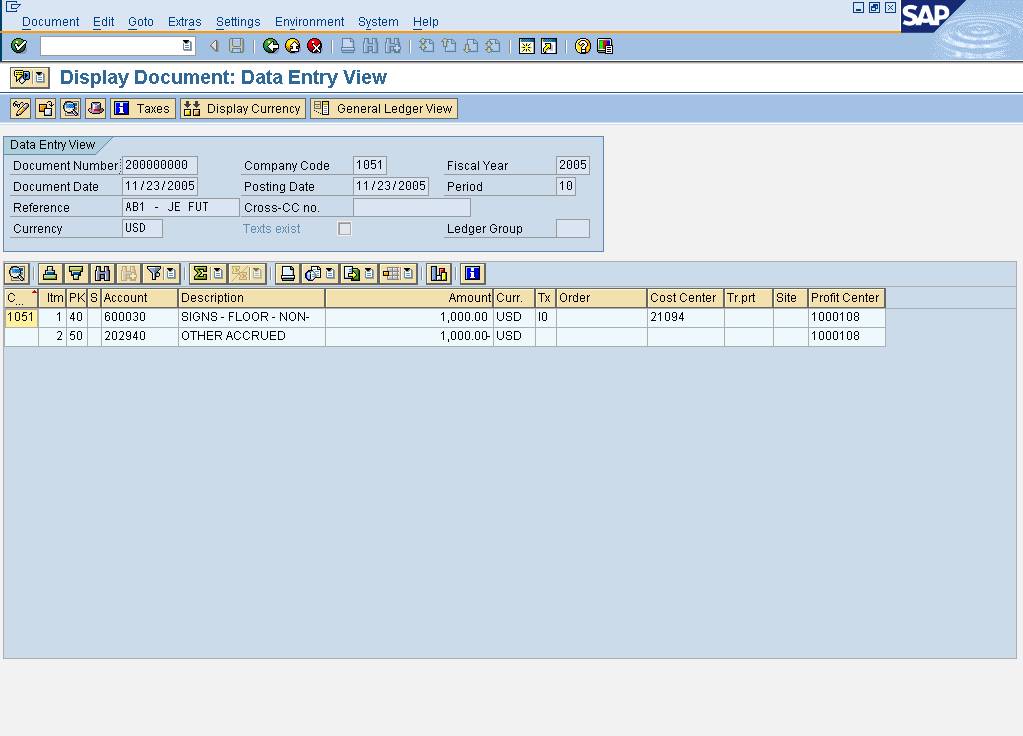

Display

Document: Data Entry View

This option allows the user to check the

document before reversal, to verify that the postings are correct.

This option allows the user to check the

document before reversal, to verify that the postings are correct.

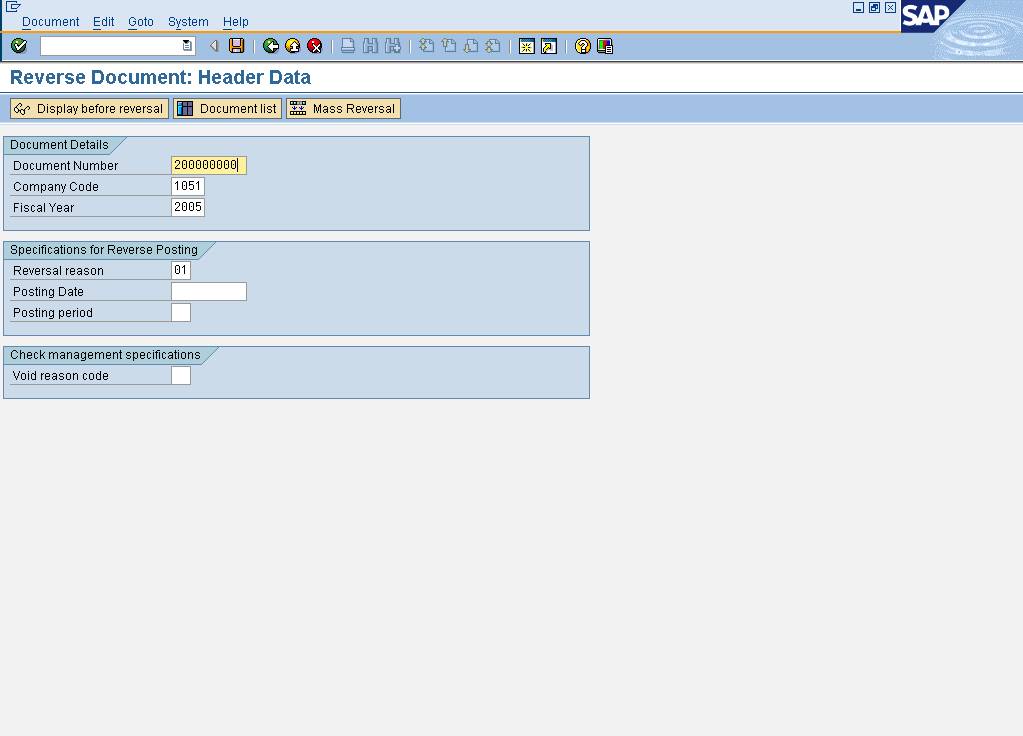

4. Click  to return to the Reverse Document: Header Data screen so that

reversal can be posted.

to return to the Reverse Document: Header Data screen so that

reversal can be posted.

Reverse Document:

Header Data

5. Click  to

post the reversal.

to

post the reversal.

The system displays the message "Document

number "XXXXXXXXXX" was posted in company code XXXX".

The system displays the message "Document

number "XXXXXXXXXX" was posted in company code XXXX".

6. You

have completed this transaction.

Result

You have reversed a document.

Comments

![]() Financial

Accounting

Financial

Accounting ![]() General Ledger

General Ledger ![]() Document

Document ![]() Reverse

Reverse ![]() Individual Reversal to go

to the reverse document screen.

Individual Reversal to go

to the reverse document screen.