Enter Incoming Invoices - FB60 (FB60)

Purpose

Use this transaction to enter incoming invoices into SAP.

When To Do This

Perform this procedure when manually entering invoices

into SAP.

Prerequisites

·

A vendor master record must exist in the system.

·

The invoice must be approved and coded prior to posting.

Menu Path

Use the following menu path to begin this transaction:

·

Select Invoice to go

to the Enter Vendor Invoice: Company Code XXXX screen.

Transaction Code

Helpful Hints

·

R/O/C: "R" = Required, "O" = Optional, "C" =

Conditional.

·

Enter all invoices for the same company code at the same time so

that the header detail does not need to be changed at each invoice entry.

Procedure

1. Please

refer to the "Internal Controls Procedures" for manual procedures that are

critical to ensuring an effective control environment for this activity.

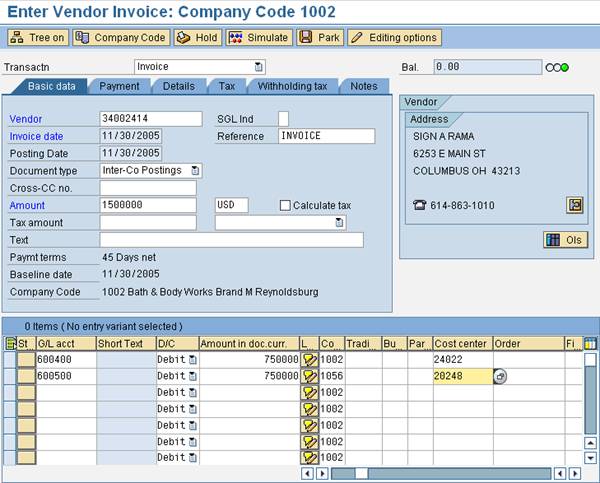

2. Start the transaction using the menu path or transaction code.

3. Perform one of the following:

|

To

|

Then

|

Go To

|

|

If changing the existing company code

|

Click  go

to the Enter Company Code window go

to the Enter Company Code window

|

Step 4

|

|

Enter invoice for 1 company code

|

|

Step 6

|

|

Change screen setting to allow inter-company postings

|

|

Step 19

|

|

Enter invoice for inter-company postings

|

|

Step 26

|

Enter

Company Code

4. As required, complete/review the following field:

|

Field Name

|

R/O/C

|

Description

|

|

Company code

|

R

|

Independent accounting

unit; in most cases is a legal entity. You can prepare a balance sheet and

income statement for each company code. Several company codes can be set up

to manage the accounts of independent companies simultaneously.

Example: 1051

|

5. Click  to continue to the Enter

Vendor Invoice: Company Code XXXX screen.

to continue to the Enter

Vendor Invoice: Company Code XXXX screen.

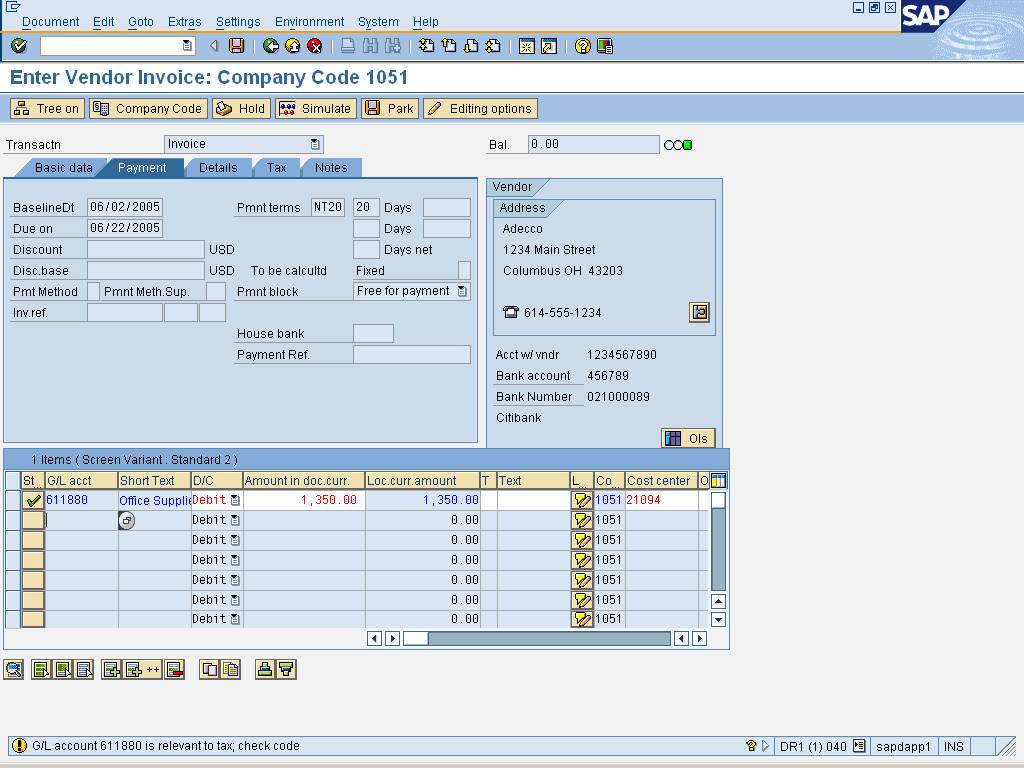

6. Click the  tab to go to the Enter

Vendor Invoice: Company Code XXXX (Basic data) screen.

tab to go to the Enter

Vendor Invoice: Company Code XXXX (Basic data) screen.

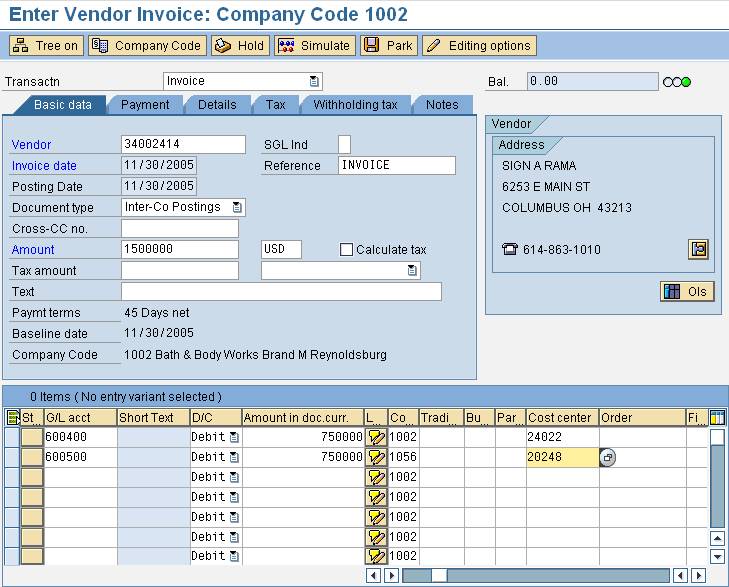

Enter

Vendor Invoice: Company Code XXXX (Basic data)

If necessary, click

If necessary, click  or

or  to scroll right or left to display the full screen.

to scroll right or left to display the full screen.

7. As required, complete the following fields:

|

Field Name

|

R/O/C

|

Description

|

|

Vendor

|

R

|

Business partner that

provides materials or services.

Example: Office

Depot

|

|

Invoice date

|

R

|

The date appearing on

the invoice.

Example: 03/15/2005

|

|

Reference

|

R

|

Allows for further

clarification of an entry by referencing to other sources of information,

either internal or external to SAP. Any SAP-posted document number can be

used as a "reference" when entering a new document.

Example: 54321

|

|

Amount

|

R

|

Total number, quantity

or value.

Example: 1350.00

|

|

G/L acct

|

R

|

Accounting ledger

created to support the creation of statutory reports.

Example: 611880

|

|

Amount in doc.curr.

|

R

|

Value in the current

location currency.

Example: 1350.00

|

|

Cost Center

|

R

|

An organizational unit

within a controlling area that represents a defined location of cost

incurrence.

Example: 21094

|

8. Click  to validate the

entries.

to validate the

entries.

The system displays the message "G/L

account XXXX is relevant to tax; check code". This message automatically

displays on all manually entered invoices but can be ignored if there is no tax

relevance to the invoice.

The system displays the message "G/L

account XXXX is relevant to tax; check code". This message automatically

displays on all manually entered invoices but can be ignored if there is no tax

relevance to the invoice.

9. Click  to validate the entry.

to validate the entry.

10. Click the  tab to go to the Enter

Vendor Invoice: Company Code XXXX (Payment) screen.

tab to go to the Enter

Vendor Invoice: Company Code XXXX (Payment) screen.

Enter

Vendor Invoice: Company Code XXXX (Payment)

Payment dates can be edited at this prompt.

Payment dates can be edited at this prompt.

11. As required, complete/review the following field:

|

Field Name

|

R/O/C

|

Description

|

|

Pmnt block

|

O

|

Payment block. Indicator

that allows you to block an account or individual items for payment.

Example: Free

for payment

|

12. Click  to validate the entry.

to validate the entry.

The system displays the message "G/L

account XXXX is relevant to tax; check code". This message automatically

displays on all manually entered invoices but can be ignored if there is no tax

relevance to the invoice.

The system displays the message "G/L

account XXXX is relevant to tax; check code". This message automatically

displays on all manually entered invoices but can be ignored if there is no tax

relevance to the invoice.

13. Click  to validate the entry.

to validate the entry.

14. Click the  tab to go to the Enter

Vendor Invoice: Company Code XXXX (Notes) screen.

tab to go to the Enter

Vendor Invoice: Company Code XXXX (Notes) screen.

Enter

Vendor Invoice: Company Code XXXX (Notes)

Important notes concerning the invoice can

be entered at this prompt.

Important notes concerning the invoice can

be entered at this prompt.

15. Perform one of the following:

|

If

|

Then

|

|

The invoice total is $5,000 or less

|

Select

|

|

The invoice total is greater than $5,000

|

Select

|

The system displays the message "G/L

account XXXX is relevant to tax; check code". This message automatically displays

on all manually entered invoices but can be ignored if there is no tax

relevance to the invoice.

The system displays the message "G/L

account XXXX is relevant to tax; check code". This message automatically displays

on all manually entered invoices but can be ignored if there is no tax

relevance to the invoice.

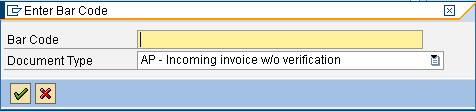

16. Click  to validate the entry and

to go to the Enter Bar Code window.

to validate the entry and

to go to the Enter Bar Code window.

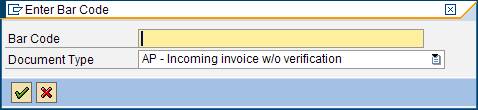

Enter Bar

Code

17. As required, complete/review the following fields:

|

Field Name

|

R/O/C

|

Description

|

|

Bar Code

|

R

|

Unique document key

(document ID) assigned to stored document by the content server. Used to

link a scanned image to an SAP document.

Example: 170000180009190008

|

|

Document Type

|

R

|

Key that identifies to

which group of documents this document will be assigned. Documents of the

same type contain common information which is relevant to posting and update

of the value fields in the data base.

Example: AP

- Incoming invoice w/o verification

|

18. Click  to validate the entry.

to validate the entry.

The system displays the message,

"Document XXXX has been parked/posted to company code YYYY."

The system displays the message,

"Document XXXX has been parked/posted to company code YYYY."

You

have completed this transaction.

You

have completed this transaction.

19. Screen set-up to enter incoming vendor invoice

for multiple companies

20. Click  .

.

Accounting Editing Options

21. As required, complete/review the following field:

|

Field Name

|

R/O/C

|

Description

|

|

Doc.type option

|

R

|

The document type

determines where the document is stored as well as the account types to be

posted.

|

22. Click  .

.

23. Click  .

.

Enter Vendor Invoice: Company Code XXXX

24. Click  .

.

Exit Editing

25. Click  .

.

SAP Easy Access

26. Start the transaction using the menu path or transaction code.

Document Type will now appear under Posting

Date.

Document Type will now appear under Posting

Date.

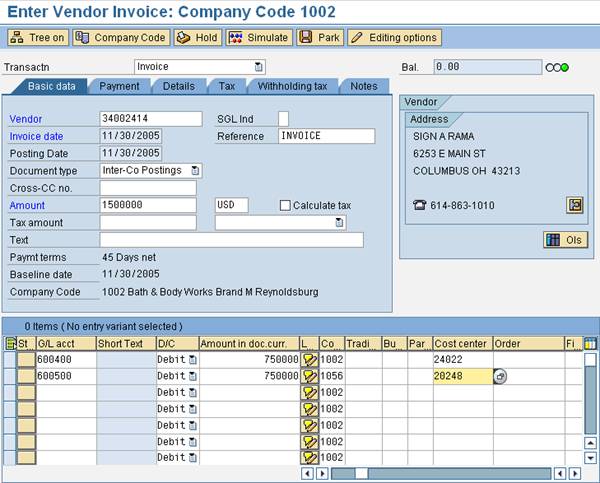

27. Change Document Type to Inter-Co Postings.

Enter Vendor Invoice: Company Code XXXX

28. As required, complete/review the following fields:

|

Field Name

|

R/O/C

|

Description

|

|

Vendor

|

R

|

Business partner that

provides materials or services.

|

|

Invoice date

|

R

|

The date appearing on

the invoice.

|

|

Posting Date

|

R

|

The date on which a

transaction in SAP will be posted to the appropriate accounts. SAP will

default this field to be the current date, but changes are allowed. For

items to be posted in a future or past period, you must enter the posting

date.

|

|

Document type

|

R

|

Key that identifies to

which group of documents this document will be assigned. Documents of the

same type contain common information which is relevant to posting and update

of the value fields in the data base.

|

|

Amount

|

R

|

Total number, quantity

or value.

|

|

Tax Amount

|

O

|

Governmental charges

applied to sales and services.

|

|

SAP Tax code

|

R

|

The tax code represents

a tax category which must be taken into consideration when making a tax

return to the tax authorities.

|

|

G/L acct

|

R

|

Accounting ledger

created to support the creation of statutory reports.

|

|

Amount in doc.curr.

|

R

|

Value in the current

location currency.

|

29. As required, complete/review the following fields:

|

Field Name

|

R/O/C

|

Description

|

|

Cost center

|

R

|

An organizational unit

within a controlling area that represents a defined location of cost

incurrence.

|

|

Company Code

|

R

|

Independent accounting

unit; in most cases is a legal entity. You can prepare a balance sheet and

income statement for each company code. Several company codes can be set up

to manage the accounts of independent companies simultaneously.

|

Enter Vendor Invoice: Company Code 1002

28. Perform one of the following:

|

If

|

Then

|

|

The invoice total is $5,000 or less

|

Select

|

|

The invoice total is greater than $5,000

|

Select

|

29. Click  to validate the entry and

to go to the Enter Bar Code window.

to validate the entry and

to go to the Enter Bar Code window.

Enter Bar Code

30. As required, complete/review the following fields:

|

Field Name

|

R/O/C

|

Description

|

|

Bar Code

|

R

|

Unique document key

(document ID) assigned to stored document by the content server. Used to

link a scanned image to an SAP document.

Example: 170000180009190008

|

|

Document Type

|

R

|

Key that identifies to

which group of documents this document will be assigned. Documents of the

same type contain common information which is relevant to posting and update

of the value fields in the data base.

Example: AP

- Incoming invoice w/o verification

|

31. Click  to validate the entry.

to validate the entry.

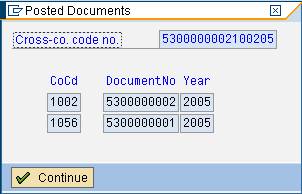

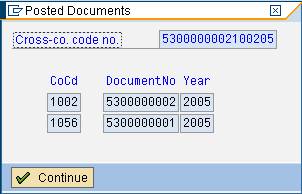

32. Click

33. The activity is now complete.

Result

You have entered a non-PO incoming invoice into SAP.

Comments

None

![]() Financial Accounting

Financial Accounting ![]() Vendors

Vendors ![]() Document

Entry

Document

Entry ![]() Invoice to go

to the Enter Vendor Invoice: Company Code XXXX screen.

Invoice to go

to the Enter Vendor Invoice: Company Code XXXX screen.