Release Blocked Invoices - MRBR (MRBR)

Purpose

Use this procedure to release blocked invoices.

When To Do This

Perform this procedure when blocked invoices are ready to

be released for payment.

Prerequisites

·

Posted invoices with a PO (MIRO) are blocked for payment. For

this transaction to work, it is critical that the lock be set at the MIRO

invoice level, not in the accounting document.

Menu Path

Use the following menu path to begin this transaction:

·

Select to continue to

the Release Blocked Invoices screen.

Transaction Code

Helpful Hints

·

R/O/C: "R" = Required, "O" = Optional, "C" =

Conditional.

·

Additional selections can be made to narrow the search criteria

of invoices that are blocked: invoice document, fiscal year, vendor, posting

date, due date, purchasing group, and user.

·

Select Release Automatically to release invoices originally

blocked at invoice verification due to no goods receipt. If the goods have

been received and the quantity and price match, the blocking reason no longer

applies and is removed. The invoice is released.

Procedure

1. Please

refer to the "Internal Controls Procedures" for manual procedures that are

critical to ensuring an effective control environment for this activity.

2. Start the transaction using the menu path or transaction code.

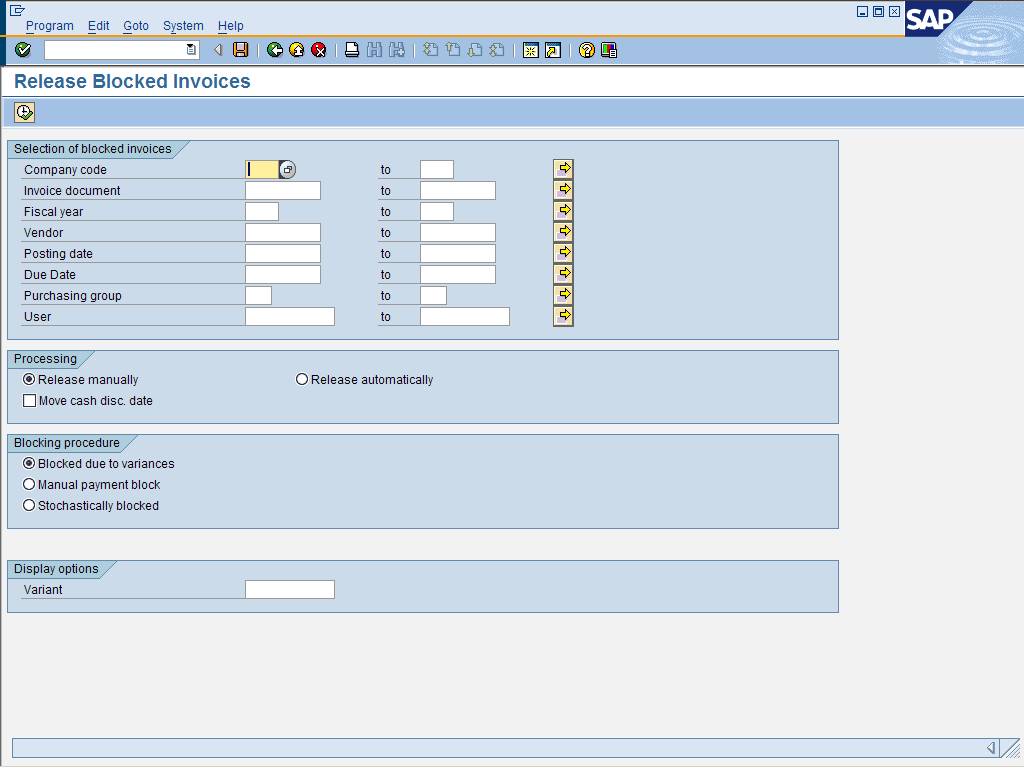

Release

Blocked Invoices

3. As required, complete the following fields:

|

Field Name

|

R/O/C

|

Description

|

|

Company code

|

R

|

Independent accounting

unit; in most cases is a legal entity. You can prepare a balance sheet and

income statement for each company code. Several company codes can be set up

to manage the accounts of independent companies simultaneously.

Example: 1051

|

|

Invoice document

|

O

|

This is the SAP document

number generated when the vendor's invoice was saved.

|

|

Fiscal year

|

O

|

The fiscal year for

which this transaction is relevant. In most cases, the fiscal year

corresponds to the calendar year.

|

|

Vendor

|

O

|

Business partner that

provides materials or services.

|

|

Posting date

|

O

|

The date on which a

transaction in SAP will be posted to the appropriate accounts. SAP will

default this field to be the current date, but changes are allowed. For

items to be posted in a future or past period, you must enter the posting

date.

|

|

Due Date

|

O

|

Date on which the

invoice is expected to be paid.

|

|

Purchasing group

|

O

|

Buyer or group of buyers

responsible for purchasing activities

|

|

User

|

O

|

Identification assigned

to a user.

|

4. Perform one of the following:

|

If

|

Go To

|

|

Releasing invoices manually

|

Step 5

|

|

Releasing invoices automatically

|

Step 16

|

5. Select  to specify manual

release processing.

to specify manual

release processing.

6. Select  to specify the

blocking procedure.

to specify the

blocking procedure.

7. Click  to continue to the Release

Blocked Invoices screen.

to continue to the Release

Blocked Invoices screen.

Release

Blocked Invoices

8. Review the displayed information.

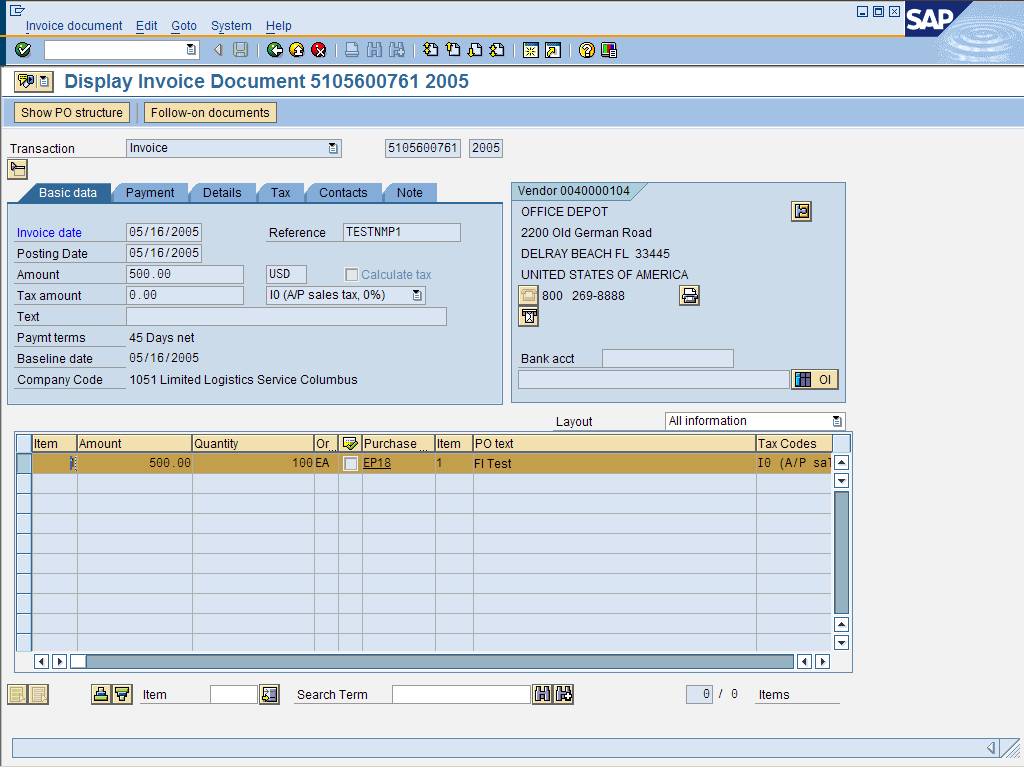

9. Click on the Doc. no. of the invoice to be released to continue to the

Display Invoice Document XXXX YYYY screen.

In this example, invoice document number

5105600761 is selected.

In this example, invoice document number

5105600761 is selected.

Display

Invoice Document XXXX YYYY

10. Review the displayed information.

11. Click  to return to the Release

Blocked Invoices screen.

to return to the Release

Blocked Invoices screen.

12. Click  to the left of the

invoice to be released.

to the left of the

invoice to be released.

To select all invoices, click

To select all invoices, click  to select all documents.

to select all documents.

13. Click  to release the selected

invoices.

to release the selected

invoices.

14. Click  to save the information.

to save the information.

The system displays the message, "XXXX

invoices released"

The system displays the message, "XXXX

invoices released"

15. This

activity is now complete.

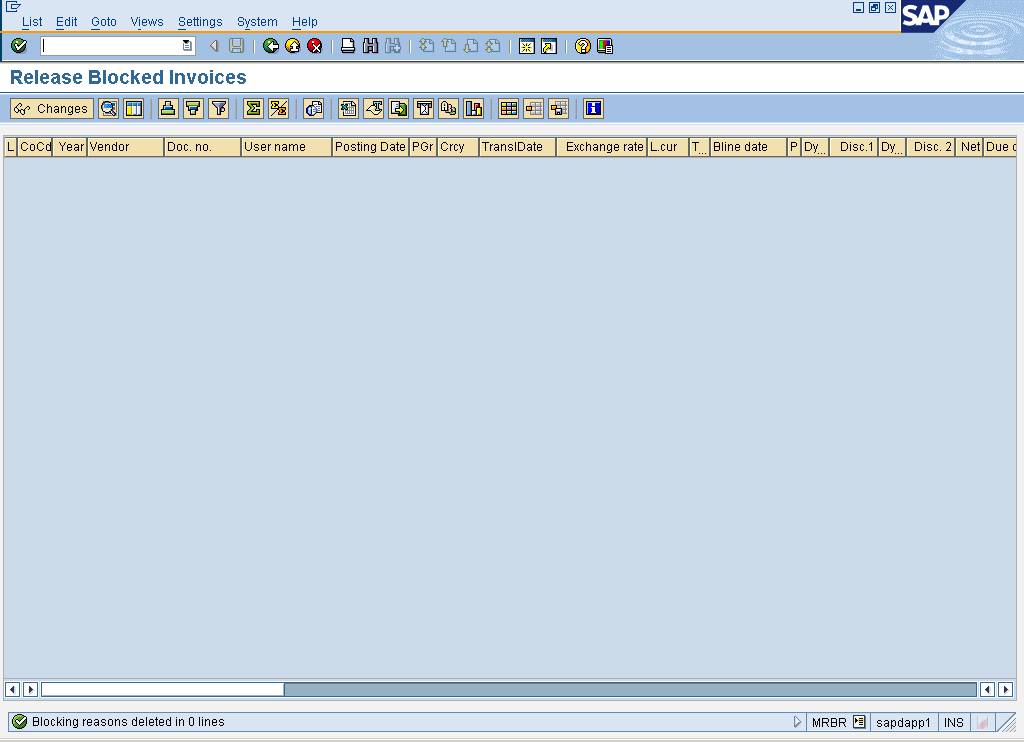

Release

Blocked Invoices

16. Click  .

.

17. Click  .

.

18. Click  .

.

Release

Blocked Invoices

The system displays the message,

"Blocking reasons deleted in XX lines."

The system displays the message,

"Blocking reasons deleted in XX lines."

Result

Blocked invoices are released

Comments

For this transaction, it is critical that

the block be done at the MIRO invoice level, not in the accounting document.

The system will not recognize the block being done in the accounting documents.

For this transaction, it is critical that

the block be done at the MIRO invoice level, not in the accounting document.

The system will not recognize the block being done in the accounting documents.

![]() Materials Management

Materials Management ![]() Logistics Invoice Verification

Logistics Invoice Verification ![]() Further Processing

Further Processing ![]() Release Blocked Invoices to continue to

the Release Blocked Invoices screen.

Release Blocked Invoices to continue to

the Release Blocked Invoices screen.