Create a Secondary Cost Element- KA06 (KA06)

Purpose

Use this transaction to create secondary cost elements.

When To Do This

Perform this procedure when an approved request for

creating a secondary cost element is received in the Shared Service Center.

Prerequisites

None

Menu Path

Use the following menu path to begin this transaction:

·

Select to access the Create Cost Element: Initial Screen.

Transaction Code

Helpful Hints

·

Use the Create with Reference function if the cost elements with

similar attributes are already available.

Procedure

1. Perform one of the following:

|

If

|

Then

|

|

Creating a secondary cost element,

|

Go to Step 2

|

|

Collectively deleting cost elements,

|

Go to Step 12

|

|

Exiting the transaction,

|

Go to Step 29

|

2. Start

the transaction using the menu path or transaction code KA06.

When accessing this transaction for the

first time in a session, the system prompts to Set

Controlling Area. The system does not prompt for the controlling area

again during the current session, indicating that controlling area LB00 has

already been set.

When accessing this transaction for the

first time in a session, the system prompts to Set

Controlling Area. The system does not prompt for the controlling area

again during the current session, indicating that controlling area LB00 has

already been set.

Use the menu path

Use the menu path

Set

Controlling Area

3. As required, complete/review the following fields:

|

Field Name

|

R/O/C

|

Description

|

|

Controlling Area

|

R

|

Self-contained

organizational unit for cost accounting.

Example: LB00

|

If the controlling is always the same,

click

If the controlling is always the same,

click  to make the entered

controlling area the default. The system will not prompt for the controlling

area in subsequent sessions.

to make the entered

controlling area the default. The system will not prompt for the controlling

area in subsequent sessions.

4. Click  .

.

Create

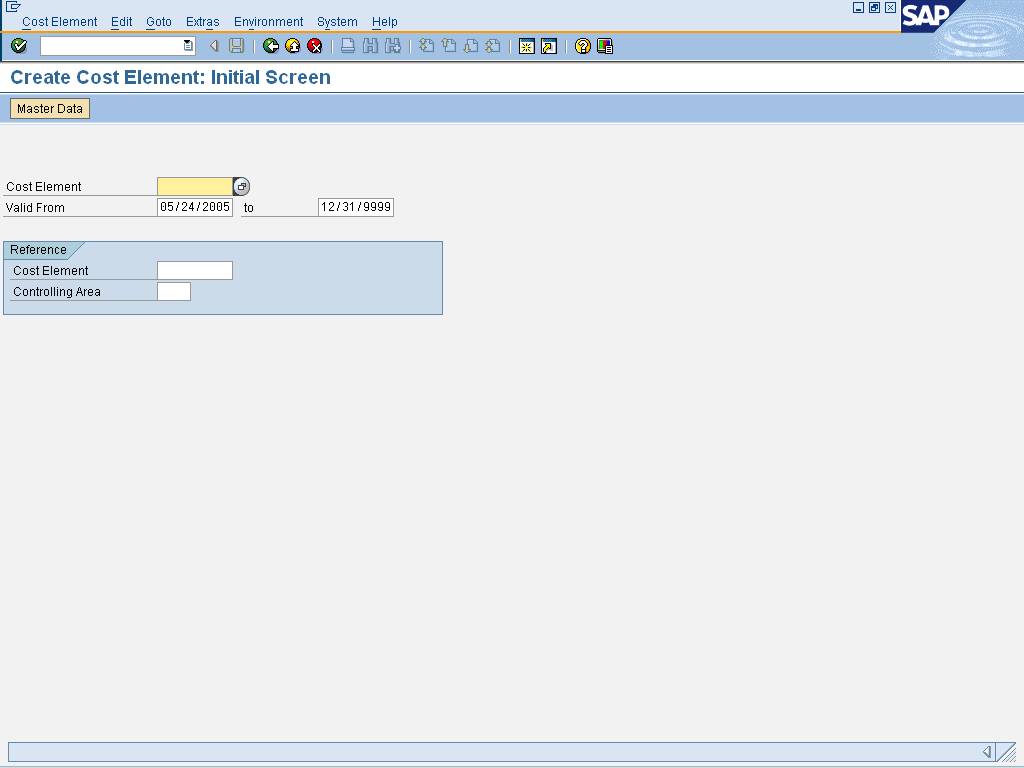

Cost Element: Initial Screen

5. As required, complete/review the following fields:

|

Field Name

|

R/O/C

|

Description

|

|

Cost Element

|

R

|

Primary cost elements

have a one-to-one relationship with general ledger expense accounts. Whenever

costs are posted, they must be assigned to a specific cost element.

Secondary cost elements, used to record internal allocations, have no

counterpart in the financial accounts and are maintained exclusively in cost

accounting.

Use number range 910000 - 919999 for

assessments; use number range 930000 - 939999 for allocations; use number

range 950000 - 959999 for internal orders. Use number range 910000 - 919999 for

assessments; use number range 930000 - 939999 for allocations; use number

range 950000 - 959999 for internal orders.

Example: 900043

|

|

Valid From

|

R

|

Beginning date when

specifying a range of dates.

Example: 01/01/00

|

|

To

|

R

|

Upper limit of the range

to be selected from a list.

Example: 01/01/2006

|

6. Click  .

.

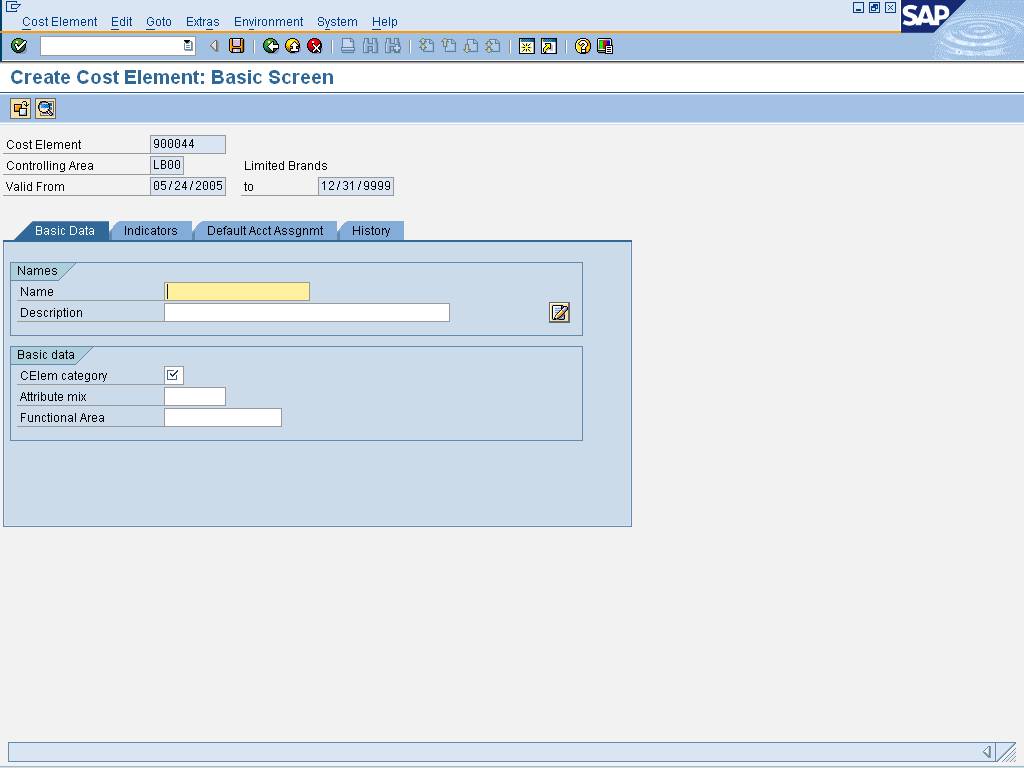

Create

Cost Element: Basic Screen

7. As required, complete/review the following fields:

|

Field Name

|

R/O/C

|

Description

|

|

Name

|

R

|

Person's, company's or

item's name.

Example: Assess-Out-DC

|

|

Description

|

R

|

Text to identify and

characterize an object or activity.

Example: Assessment

- Distribution act from LLS

|

|

Cost Element Category

|

R

|

An attribute that

determines the type of cost element.

Example: 42

|

The following table explains when to select

which cost element category:

The following table explains when to select

which cost element category:

|

If

|

Then

|

|

The cost element is for internal settlements

|

Use Cost Element Category 21.

|

|

The cost element is for assessments

|

Use Cost Element Category 42

|

|

The cost element is for allocations,

|

Use Cost Element Category 43

|

8. Click the  tab.

tab.

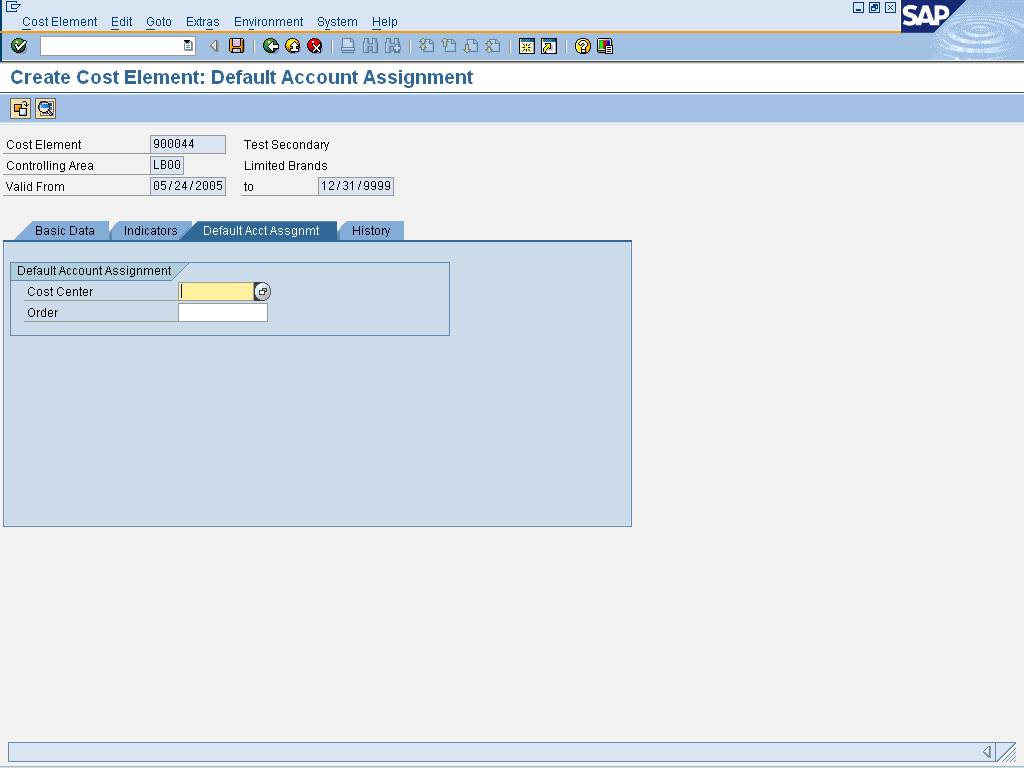

A cost center or an order can be set as a

default account assignment object. However, it is not advisable to default at

the cost element level.

A cost center or an order can be set as a

default account assignment object. However, it is not advisable to default at

the cost element level.

Create

Cost Element: Default Account Assignment

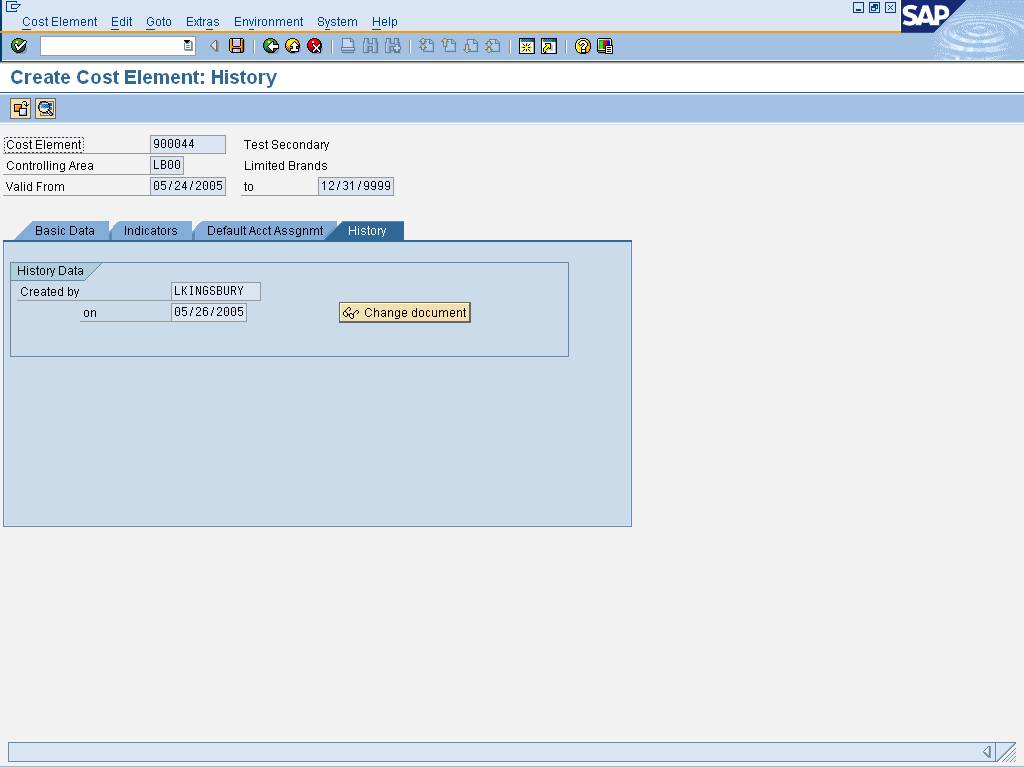

9. Click the  tab.

tab.

Create

Cost Element: History

10. Click  .

.

The system displays the message "Cost

Element XXXX has been created."

The system displays the message "Cost

Element XXXX has been created."

11. Return

to Step 1

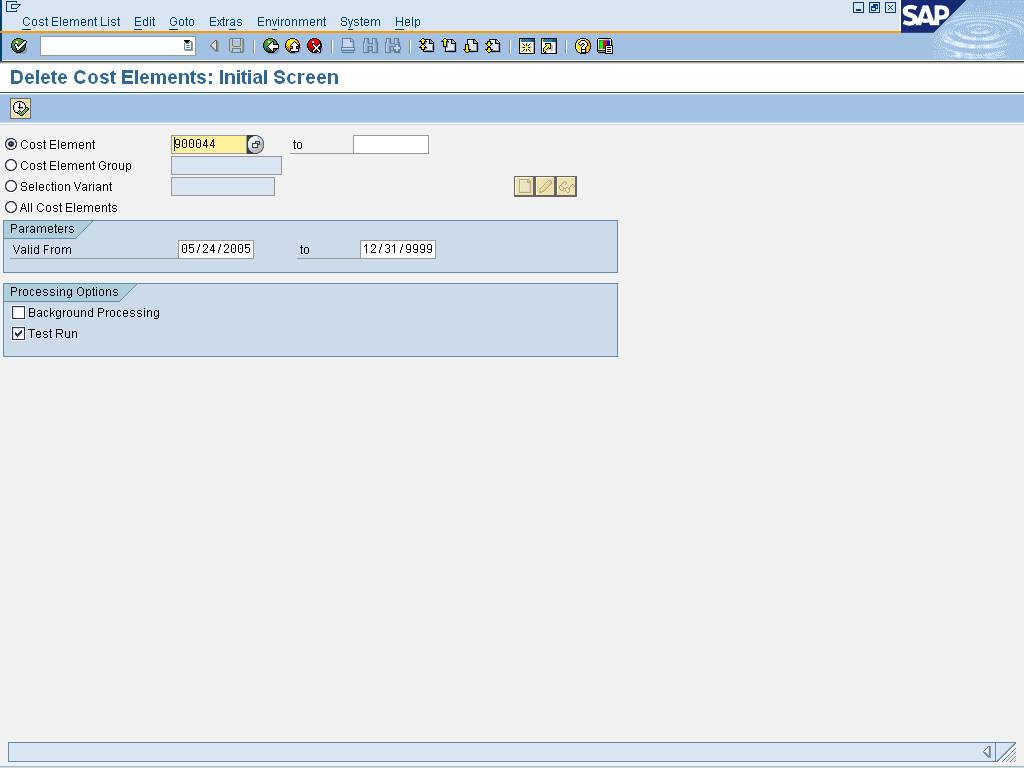

12. Start the transaction using the menu path or transaction code KA24.

Delete

Cost Elements: Initial Screen

13. As required, complete/review the following fields:

|

Field Name

|

R/O/C

|

Description

|

|

Cost Element

|

R

|

Primary cost elements

have a one-to-one relationship with general ledger expense accounts. Whenever

costs are posted, they must be assigned to a specific cost element.

Secondary cost elements, used to record internal allocations, have no

counterpart in the financial accounts and are maintained exclusively in cost

accounting.

Example: 900043

|

14. Select  to delete a range of

cost elements.

to delete a range of

cost elements.

15. Select  to delete a cost

element group.

to delete a cost

element group.

16. As required, complete/review the following fields:

|

Field Name

|

R/O/C

|

Description

|

|

Cost Element Group

|

R

|

Hierarchical grouping of

cost elements created to facilitate data entry and reporting.

Example: LTS-A

|

17. Select  to delete the cost

elements which are a part of a selection variant.

to delete the cost

elements which are a part of a selection variant.

A selection variant allows for the storage of

a defined data set.

A selection variant allows for the storage of

a defined data set.

18. As required, complete/review the following fields:

|

Field Name

|

R/O/C

|

Description

|

|

Selection Variant

|

R

|

Saved selection criteria

used to generate reports. Instead of entering new criteria every time a

report is executed, sets of criteria can be stored. Reports can have

different variants associated with them, with each variant providing

different information.

Example: SEL-1

|

19. Select  to delete all the cost

elements.

to delete all the cost

elements.

20. As required, complete/review the following fields:

|

Field Name

|

R/O/C

|

Description

|

|

Valid From

|

R

|

Beginning date when

specifying a range of dates.

Example: 01/01/2001

|

|

to

|

R

|

Upper limit of the range

to be selected from a list.

Example: 12/31/9999

|

21. Select  to delete in the

background.

to delete in the

background.

22. Select  .

.

It is advisable to perform the delete first

in a test run and determine if there are errors prior to performing the actual

delete.

It is advisable to perform the delete first

in a test run and determine if there are errors prior to performing the actual

delete.

23. Click  .

.

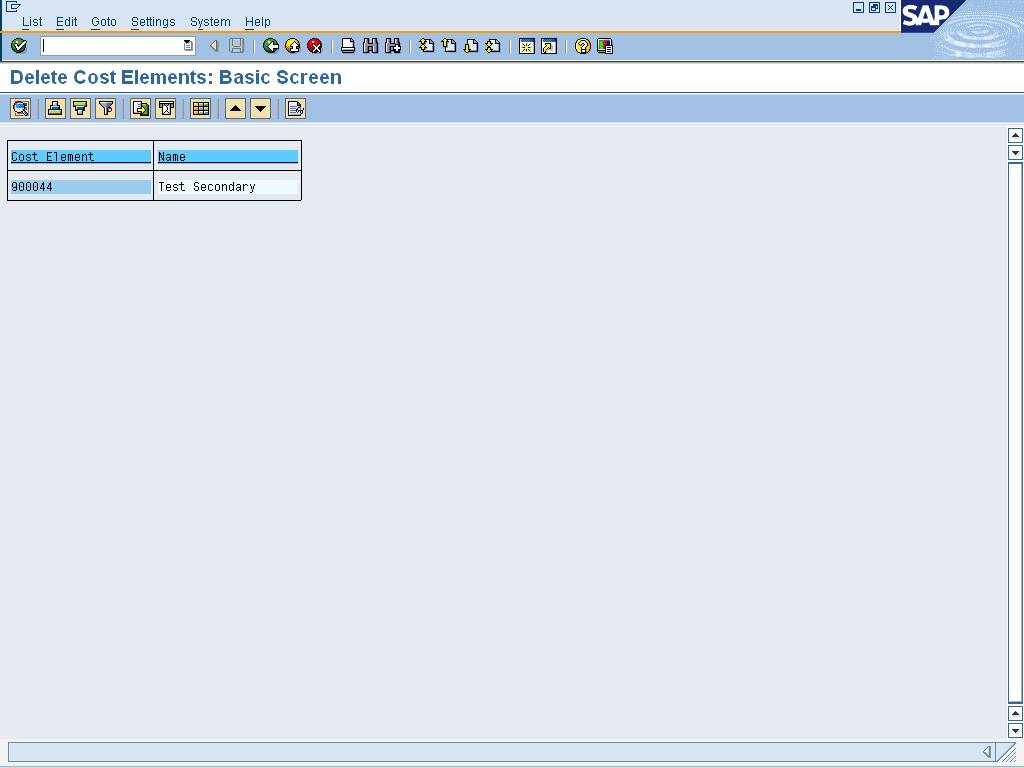

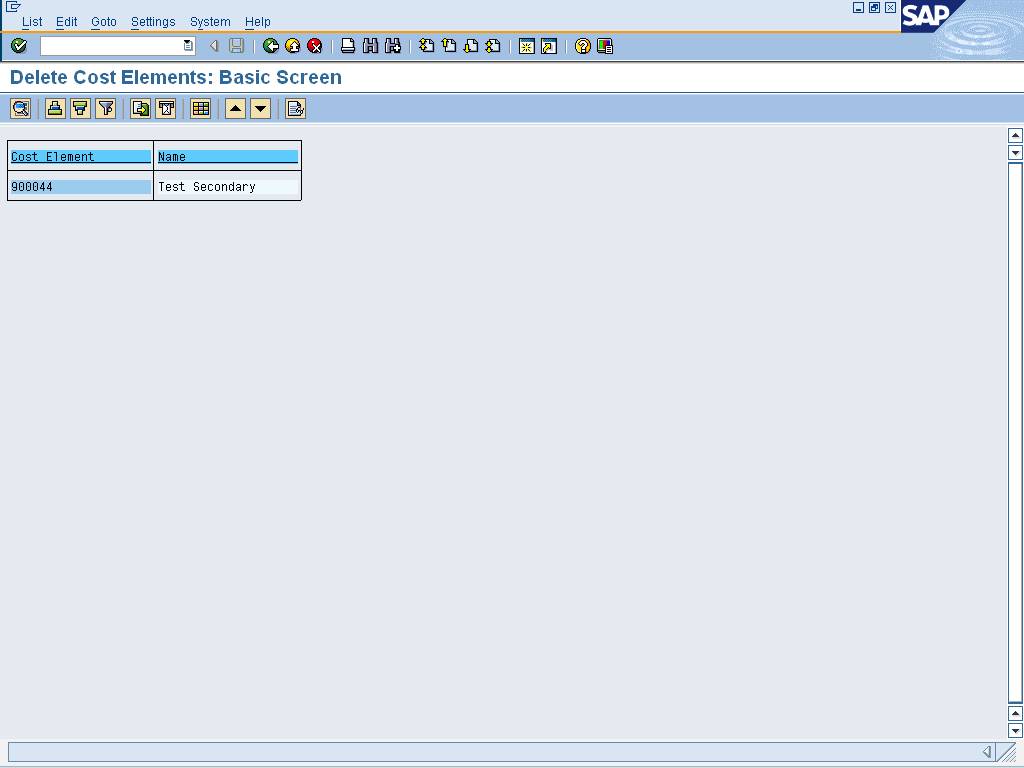

Delete

Cost Elements: Basic Screen

24. Click  to return to the Delete Cost Elements: Initial Screen.

to return to the Delete Cost Elements: Initial Screen.

Delete

Cost Elements: Initial Screen

25. Deselect  .

.

26. Click  .

.

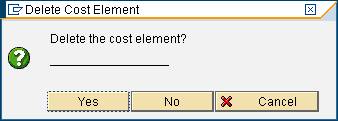

Delete

Cost Element

27. Click  to delete the cost

element.

to delete the cost

element.

Delete

Cost Elements: Basic Screen

It is not possible to delete the cost

elements if the transaction data posted to the cost element. However, they can

be deleted for future periods.

It is not possible to delete the cost

elements if the transaction data posted to the cost element. However, they can

be deleted for future periods.

28. Click  to return to the Delete Cost Elements: Initial Screen.

to return to the Delete Cost Elements: Initial Screen.

29. You have completed the transaction.

Result

You have successfully created a secondary cost element.

Also, you have successfully deleted all the cost elements.

Comments

None

![]() Controlling

Controlling ![]() Cost Element Accounting

Cost Element Accounting ![]() Master Data

Master Data ![]() Individual processing

Individual processing ![]() Create secondary to access the Create Cost Element: Initial Screen.

Create secondary to access the Create Cost Element: Initial Screen.