Procedure

1. Please refer to the "Internal Controls Procedures" for manual procedures that are critical to ensuring an effective control environment for this activity.

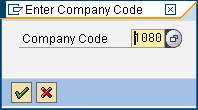

2. Start the activity using the menu path or transaction code.

![]() Park Customer Invoice: Company Code 1080

Park Customer Invoice: Company Code 1080

3. Click ![]() to select the

Company Code for posting.

to select the

Company Code for posting.

Enter Company Code

|

|

4. As required, complete/review the following fields:

![]() Enter Customer

Invoice: Company Code 1080

Enter Customer

Invoice: Company Code 1080

6. As required, complete/review the following header fields:

· Customer

· Amount

· Text

![]() SAP provides fields in the

Invoice header for entry of tax amounts, tax codes, and a checkbox for the

system to calculate taxes automatically. This tax functionality is not

included within the LimitedBrands design. Any tax amount to be included in

the invoice/credit memo should be included in the total of the invoice (Amount

field in the header).

SAP provides fields in the

Invoice header for entry of tax amounts, tax codes, and a checkbox for the

system to calculate taxes automatically. This tax functionality is not

included within the LimitedBrands design. Any tax amount to be included in

the invoice/credit memo should be included in the total of the invoice (Amount

field in the header).

The user should then select the appropriate tax GL account and enter an additional line item (sales in one line, tax in a separate line). The total of the two lines should equal the Amount in the header. Sales Tax or something that clearly identifies the charge should be entered as text for the tax line as this text will appear on the invoice.

![]() The invoice header is complete.

The next step is to enter line item data for the invoice. Enter the target GL

account data to offset the debit/credit to the customer's account. Portions of

the line item data will display on the invoice, i.e., Amount in Document

Currency, Line Item Text, etc.

The invoice header is complete.

The next step is to enter line item data for the invoice. Enter the target GL

account data to offset the debit/credit to the customer's account. Portions of

the line item data will display on the invoice, i.e., Amount in Document

Currency, Line Item Text, etc.

7. As required, complete/review the following GL offset fields:

· G/L acct

· Text

8. Click ![]() in order to

add additional information to the invoice if the above fields do not fulfill

the requirement. The fields listed will appear on both the invoice image when

printed, and within the customer sub-ledger account for reference/search

capability.

in order to

add additional information to the invoice if the above fields do not fulfill

the requirement. The fields listed will appear on both the invoice image when

printed, and within the customer sub-ledger account for reference/search

capability.

![]() Park Customer

Invoice: Company Code 1080

Park Customer

Invoice: Company Code 1080

9. As required, complete/review the following fields:

![]() Ref Key fields appear on the

invoice image and within the customer account, but do not appear in the offset

GL account. If an item needs to be searchable within the offset account,

utilize a field from the GL Line Item when entering the invoice/credit memo.

Ref Key fields appear on the

invoice image and within the customer account, but do not appear in the offset

GL account. If an item needs to be searchable within the offset account,

utilize a field from the GL Line Item when entering the invoice/credit memo.

· RefKey 3

10. Click ![]() to add long text

to the invoice document. This will allow the user to include additional

details the customer may require on the document.

to add long text

to the invoice document. This will allow the user to include additional

details the customer may require on the document.

![]() Notes entered here appear on

the invoice!

Notes entered here appear on

the invoice!

![]() Park Customer

Invoice: Company Code 1080

Park Customer

Invoice: Company Code 1080

11. As required, complete/review the following fields:

· Notes

12. Click ![]() to park the

document for review/posting.

to park the

document for review/posting.

![]() The system displays the message,

"Document 1800004000 1080 was parked."

The system displays the message,

"Document 1800004000 1080 was parked."

13. This activity is now complete.

A parked invoice/credit memo was successfully entered and is pending review for posting.

Comments

xxxx.